Northern Europe still leads the race

No region embodies electrification more completely than the Nordics. In the first half of 2025, Norway maintained its global leadership with an extraordinary 91 % BEV market share and roughly 56 300 new electric cars sold. It also operates one of the world’s most mature charging networks, now exceeding 34 000 public points, including 10 400 DC fast chargers.

Denmark follows with a 61.4 % BEV share and 52 900 sales, while Sweden and Finland reached 34 % and 32 % respectively. Fiscal incentives, strong consumer trust, and nationwide charging coverage underpin this leadership. These nations have effectively normalised the electric car: BEVs are no longer a niche choice but the default option.

Western Europe: scale and diversity

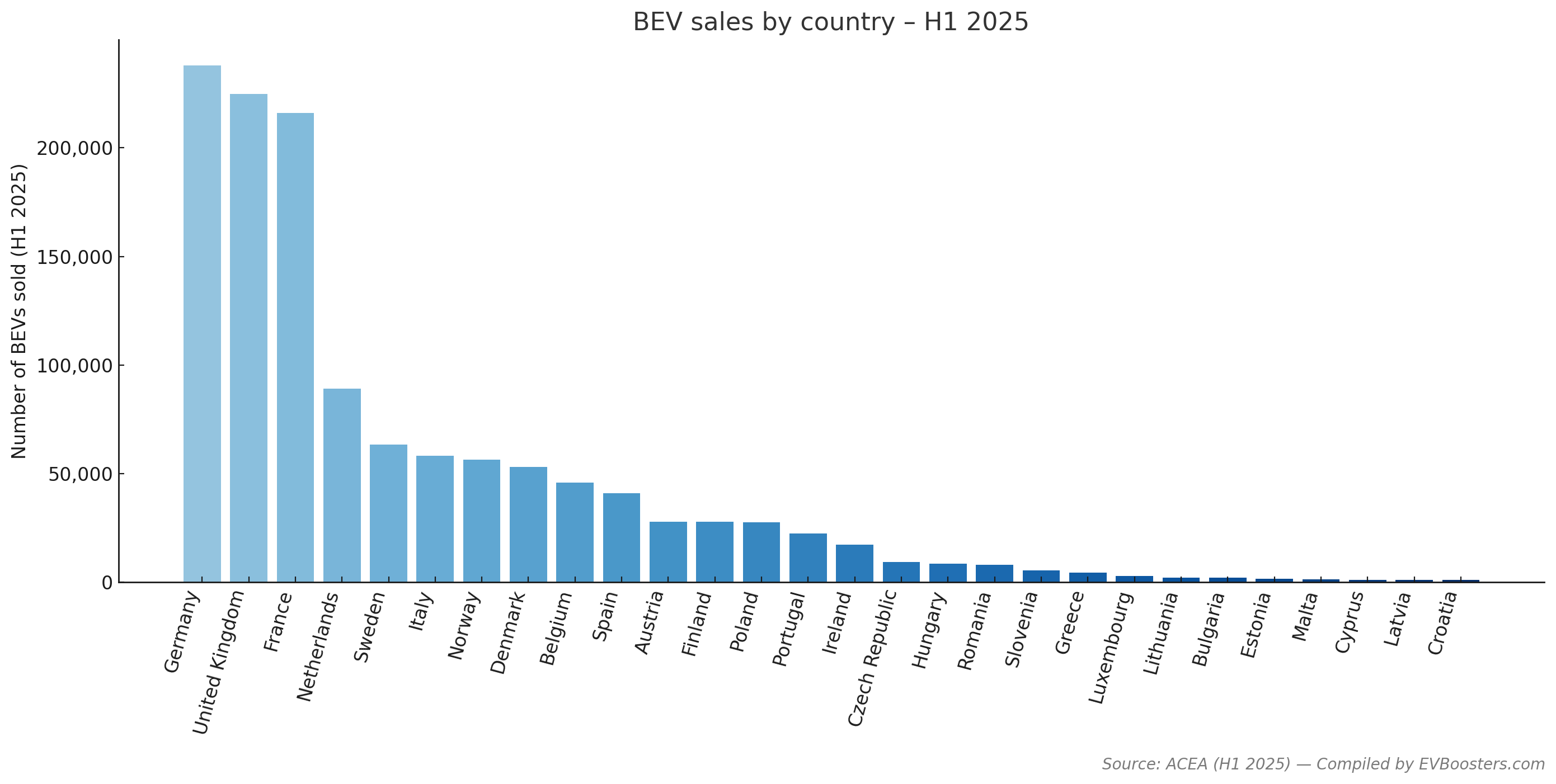

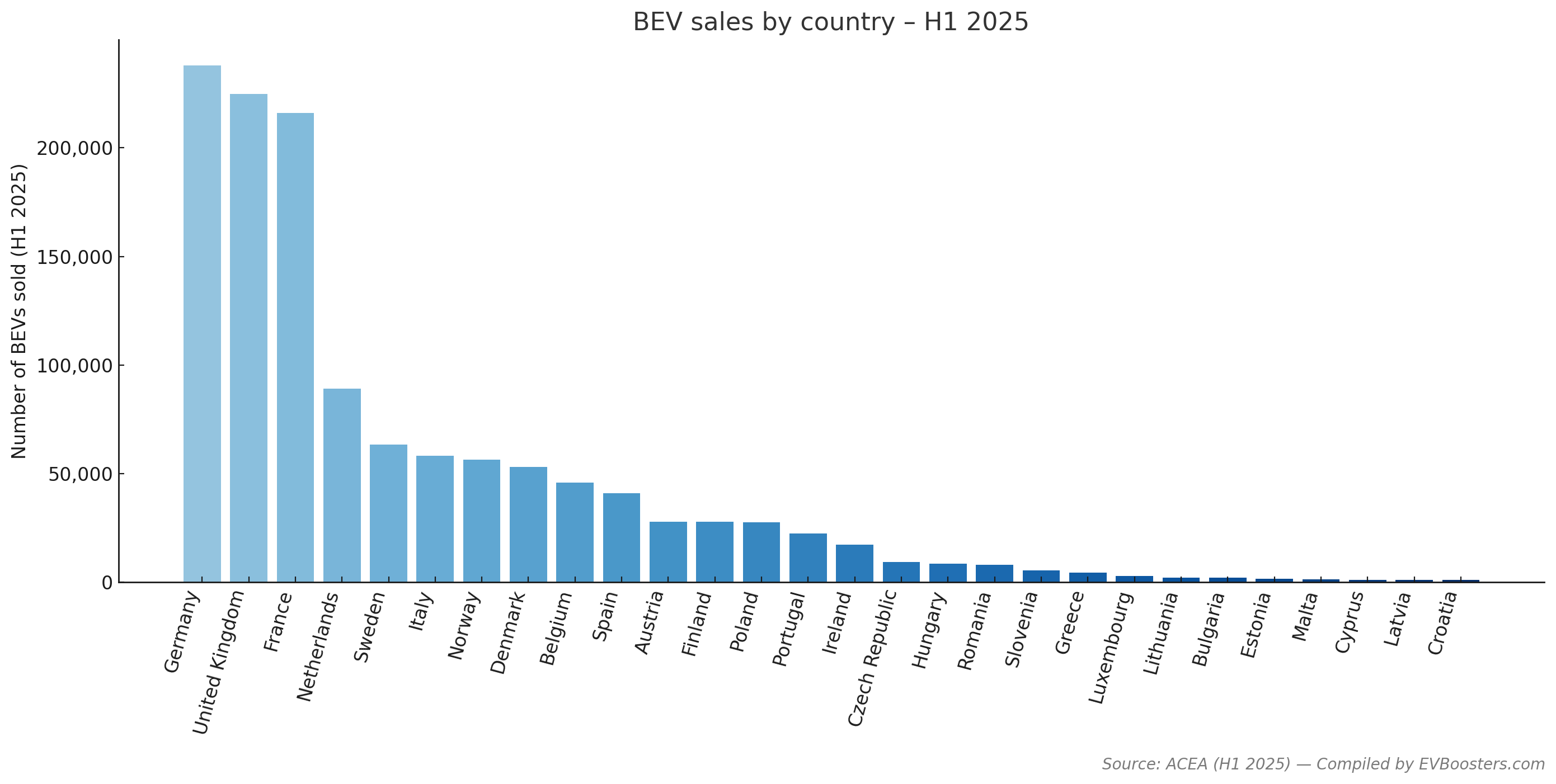

Western Europe delivers the continent’s largest sales volumes but also the greatest disparities.

According to ACEA, Germany remains Europe’s biggest BEV market with 238 000 units sold in H1 2025, accounting for 17.1 % of new registrations. France follows closely with 216 000 sales (16.5 %), driven by national purchase bonuses and fleet electrification.

The Netherlands keeps its high-adoption trajectory, hitting a 35 % BEV share and 89 100 sales, supported by one of the world’s densest charging networks—over 215 000 AC and 7 800 DC points as of September 2025 (EAFO).

The United Kingdom, no longer an EU member but still a key European market, reported 224 841 BEV registrations in the first half of 2025—up 34.6 % year-on-year and representing 21.6 % market share (SMMT). Zapmap counts 86 021 public charging devices, of which 17 356 are rapid or ultra-rapid DC, underscoring Britain’s focus on motorway charging rather than dense urban AC networks.

Together, Germany, France, the UK and the Netherlands account for more than 60 % of all BEV sales and nearly the same share of Europe’s public charging infrastructure.